Subdivision projects can be lucrative ventures, offering significant returns on investment. However, to achieve these returns, careful financial planning is crucial. In Auckland, where property values and development regulations are dynamic, understanding the financial landscape is essential. This article delves into the key aspects of financial planning for subdivision projects in Auckland, providing insights to help developers maximize their profitability.

Understanding the Market

Current Trends in Subdivision Auckland

The Auckland property market is known for its fluctuations, influenced by factors such as government policies, economic conditions, and demographic changes. As of recent years, there has been a growing demand for residential properties, leading to increased opportunities for subdivision projects. Developers must stay abreast of these trends to make informed decisions about when and where to invest.

Identifying Profitable Locations

Location is a critical determinant of a subdivision project’s success. Areas experiencing rapid population growth, improved infrastructure, and high demand for housing are prime targets. Conducting thorough market research to identify such areas can significantly enhance profitability. Engaging with local real estate experts and studying regional development plans can provide valuable insights.

Budgeting and Cost Estimation

Initial Investment and Land Acquisition

Acquiring land is the first and often the most substantial expense in a subdivision project. Developers must carefully assess the cost of land, considering factors such as location, size, zoning regulations, and potential for future growth. It’s essential to have a clear understanding of the market value and negotiate effectively to secure land at a reasonable price.

Development Costs

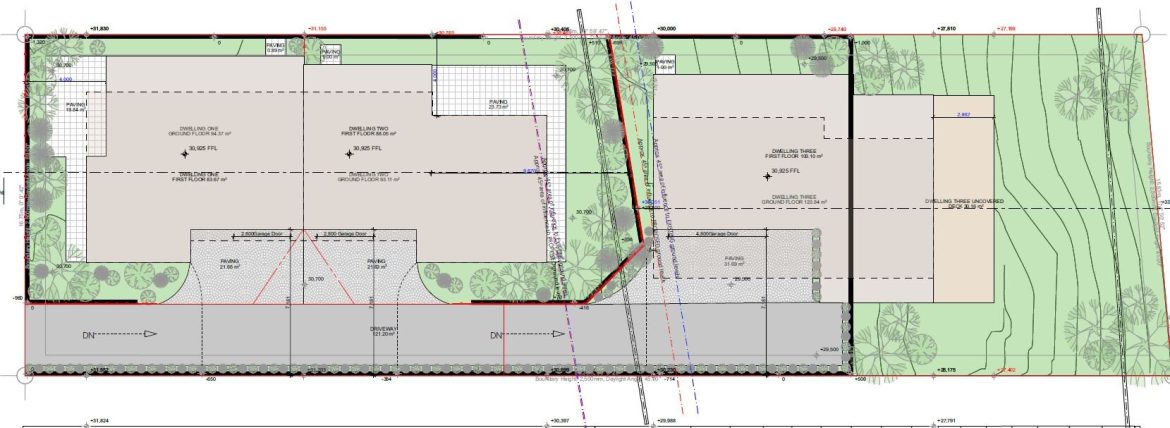

Subdivision projects involve various development costs, including site preparation, infrastructure development (roads, utilities, drainage), and construction. Accurate cost estimation is crucial to avoid budget overruns. Engaging with experienced contractors and consultants can help in obtaining precise cost projections and identifying potential cost-saving measures.

Regulatory Compliance and Permits

In Auckland, subdivision projects must comply with local zoning laws, building codes, and environmental regulations. Securing the necessary permits and approvals can be time-consuming and costly. Developers should allocate a portion of their budget for these expenses and consider the potential impact of regulatory delays on their project’s timeline and profitability.

Financial Strategies for Profit Maximization

Financing Options

Securing adequate financing is vital for the successful execution of subdivision projects. Developers can explore various financing options, including bank loans, private investors, and joint ventures. Each option has its advantages and risks, and the choice depends on the project’s scale, developer’s financial health, and market conditions. It’s advisable to work with financial advisors to determine the most suitable financing strategy.

Cost Control Measures

Effective cost control is essential to maintain profitability. Implementing measures such as competitive bidding for contractors, bulk purchasing of materials, and efficient project management can help in keeping costs within budget. Regular financial audits and monitoring can also identify any deviations and allow for timely corrective actions.

Pricing and Sales Strategy

Setting the right price for subdivided lots or completed homes is crucial for maximizing returns. Developers should conduct a comparative market analysis to understand the pricing trends in the target area. A well-thought-out sales strategy, including marketing campaigns, attractive financing options for buyers, and engaging with reputable real estate agents, can accelerate sales and enhance profitability.

Risk Management

Identifying Potential Risks

Subdivision projects are inherently risky, with potential challenges such as market fluctuations, construction delays, and regulatory changes. Identifying these risks early and developing mitigation strategies can safeguard the project’s financial viability. Conducting a thorough risk assessment and scenario planning can help in anticipating and addressing potential issues.

Contingency Planning

Allocating a contingency budget to cover unexpected expenses is a prudent financial planning practice. This buffer can help in managing unforeseen challenges without compromising the project’s overall financial health. Regularly reviewing and adjusting the contingency plan based on project progress and emerging risks is also advisable.

Conclusion

Financial planning is the cornerstone of successful subdivision Auckland. By understanding the market, accurately estimating costs, implementing effective financial strategies, and managing risks, developers can maximize their profitability and achieve their investment goals. Staying informed about the latest market trends and regulatory changes, and seeking professional advice when needed, can further enhance the chances of success in the competitive Auckland property market.